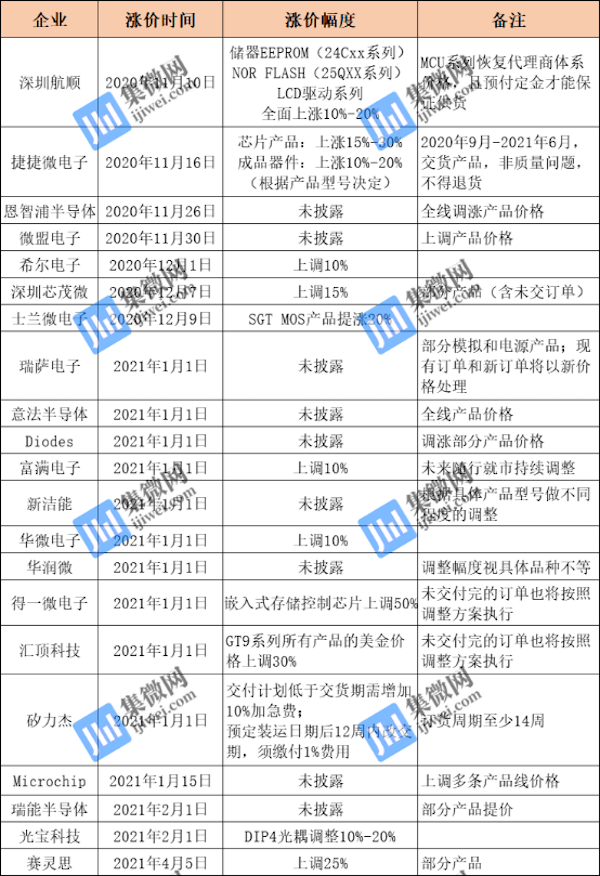

Semiconductor product price rise is continuing in China as its industry entered 2021. An incomplete count by ijiwei - China's top online media for semiconductor industry - shows that at least 21 companies have issued open notices to their customers on their price increase since last November or to start from April this year. The list includes both multinational and local big-name companies such as NXP, ST, Microchip, Goodix and Silan.

The price increase is mostly between 10% to 20% for products including MOS, power management, MCU, automobile electronics and memory. But Yeestor - an embedded memory controller provider in Shenzhen - is a noticeable case with 50% hike. Industry insiders predict that this trend will stay until the second half of 2021.

Another report by China Flash Market shows a 5% surge of flash memory products in China since last December and over 10% in certain channels.

In their notices, most suppliers attributed their price adjustment to the continued rise of upstream raw materials, higher packaging costs, extended procurement cycle and tightened production capacity resulting from COVID-19 pandemic. The core factor for this round of price surge is traced to tighter wafer supply. In early 2020, many original equipment manufacturers had conservative market demands for the year, the outbreak of the pandemic unleased demand for more online activities and digital equipments, causing more needs for IC and semiconductor solutions. Then many device manufacturers began to stock up IC and other components.

The ongoing Sino-U.S. trade war continues to be tense. As a result, there is planned and large-scale hoarding by domestic manufacturers and IC distributors. Some mobile phone manufacturers began to purchase large number of components in order to pick up market shares left by Huawei due to the U.S. sanctions on it. All these contributed to disturbing wafer capacity.

The price hike of IC and semiconductors started to hit China market since last October, causing industry wide concern. Some industry insiders pointed out potential inflated demands. For example, one customer may have 1K procurement order, it is sent to five suppliers and counted as 5K demand by market.

In interviews with ijiwei, some IC company executives expressed caution with price increase at the moment and take into consideration their long-term cooperation with their clients. But when upstream cost pressure goes up, they would discuss with customers to share the cost pressure.

Lin Yongyu, chairman of Stardawns Technology, a leading AI chip supplier for security camera based in Xiamen, said, "Wafer supply for us now is normal because of our leading position in the supply chain. We have not done price adjustments. But if the future cost increase is large, we need to fine-tune our price according to the market. We will handle the matter in full consultation with our customers."

He Jianxiong, deputy general manager of SinhMicro, which specializes in Power MCU products in Zhuhai of southern Guangdong Province, also admitted to a similar situation in his company operation and has no price change now because of timely preparation in the early stage. "When we have to increase price, it will be expected to be within 10%," he said.

Shanghai MindMotion, a popular SoC solutions provider, promised no price change in the first quarter of 2021 in the company's circular on January 8th. It says, "At this difficult time, we will do everything possible to minimize the impact on customers and will not adjust product prices in the first quarter of 2021."

Cao Zhiping, VP and general manager of STMicroelectronics China - the global leading MCU supplier told ijiwei in a recent interview that his company will increase production capacity this year to meet the challenge of tight supply and demand.

"We have taken a lot of actions. More capital will be invested into our production in 2021. We can meet the challenges of temporary supply shortages," he said.

Wang Huilian, managing director and general manager of Xiamen Semiconductor Investment Group, predicted that wafer production capacity shortage in 2020 will continue into the third quarter to the fourth quarter of 2021.

登录

登录